Market Focus

- EIA releases monthly Short-Term Energy Outlook report

- Domestic refined oil initiates a new round of price adjustment window

- US July Non-Seasonally Adjusted CPI YoY, US July Seasonally Adjusted CPI MoM, US Initial Jobless Claims as of August 5

- US July Non-Seasonally Adjusted Core CPI YoY, US EIA Natural Gas Inventory as of August 4

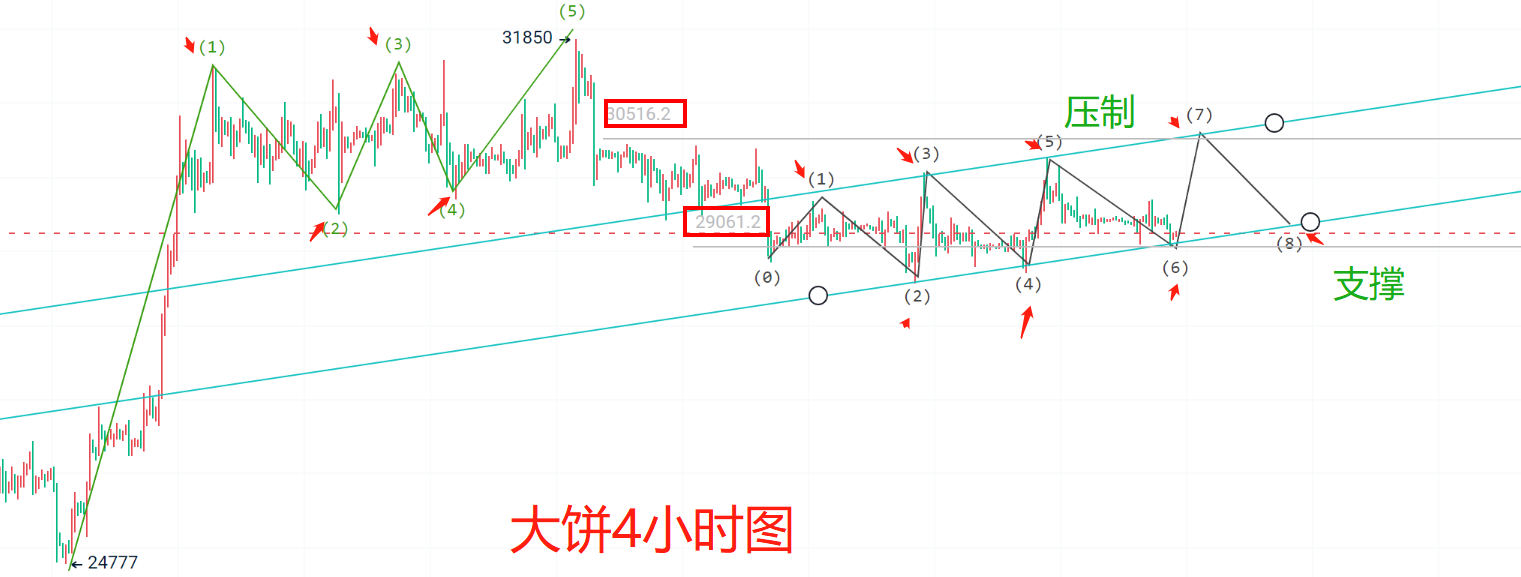

The recent trend of the "big cake" has been consistently weak and downward. After yesterday's further decline, the downward trend of the coin price is also entering the final stage. Since the consolidation started at 29,400, there have been multiple attempts to push higher, but ultimately ended in failure. It is also a reminder to be cautious of sharp market movements. Therefore, short-term operations are not recommended for most coin enthusiasts.

From a technical perspective, the market has been in a downtrend, and multiple rebounds in the coin price have all ended in failure, indicating the short-term inability of the bulls to push higher. As of now, the market has already fallen below the 29,400 level, indicating that the overall market recovery has not yet been completed and support needs to be found. However, as the market fluctuates over time, the lower point has not continued to decline. From the chart, it can be seen that the low point of 29,000 has completed a cyclical bottoming out. It was also mentioned yesterday that even if there is a retracement below, it is difficult to break the current range.

In terms of chip distribution, the market's decline has not changed the current stage of chip accumulation, which is still in the 29,000/30,000 range. At the same time, the decline in the 4-hour chart has not broken the support of the 6th wave. Although the current liquidity is low, the slight consolidation also indicates that the buying momentum still exists. Therefore, this round of operation continues to follow the bullish thinking!

Recommended entry points: Long positions near 29,200-29,000, with targets at 29,600-30,000-30,500

The winds of July, the rains of August, there will definitely be better luck in the second half of the year. This month's trading record for Blue Planet: 6 wins, 2 losses, win rate 75%, profit 3,300 points, loss 600 points. Real-time updates across the network (small currencies not recorded).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。