昨晚BTC下跌,主力大单(AICoin独家首创)、8小时周期+MA40、量价分布图,这3大指标交易法均捕抓到下跌。

成为PRO K线用户,使用3大指标,立即拥有:https://www.aicoin.com/vip/chartpro

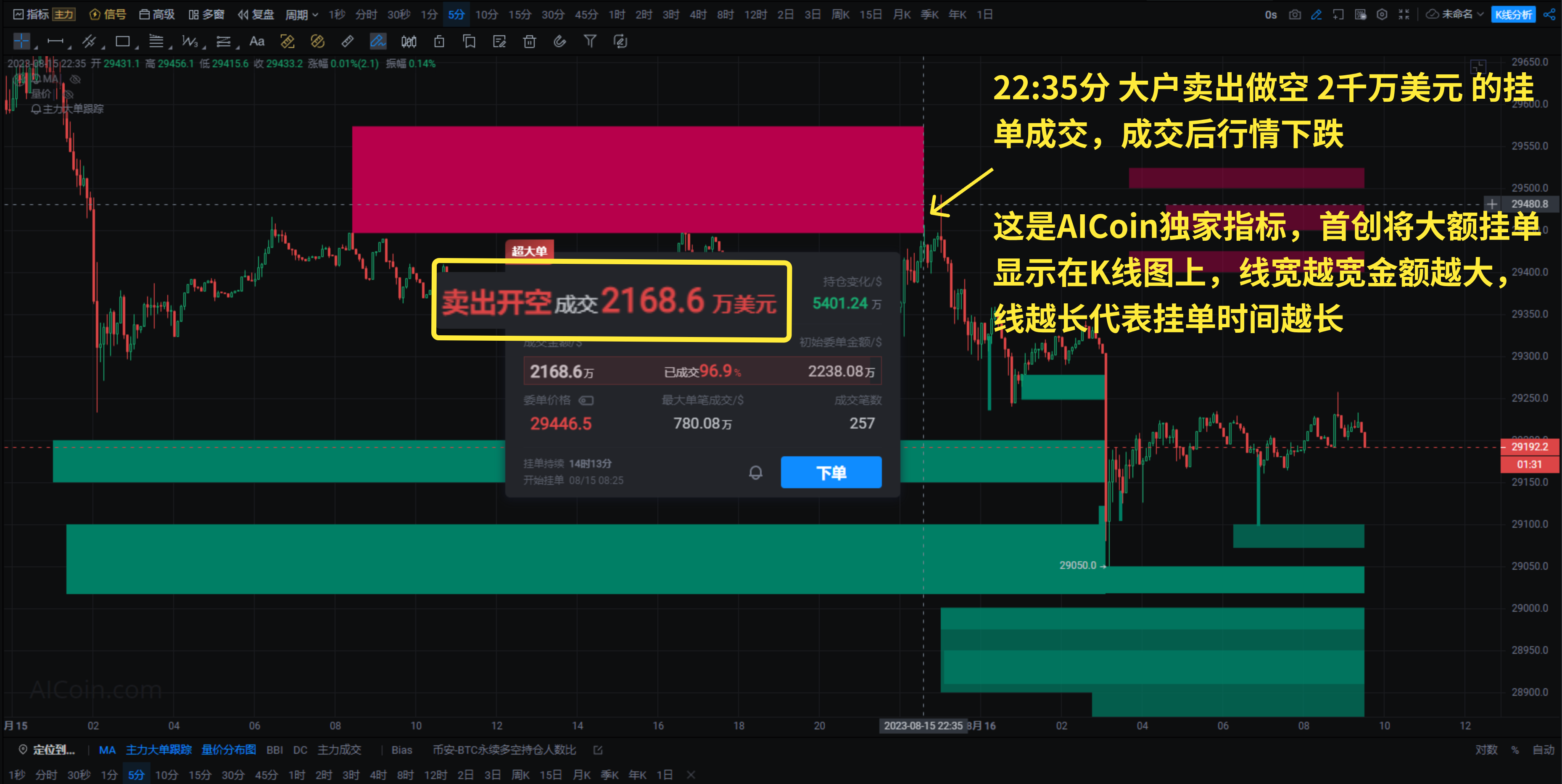

1、主力大单——捕抓到大户卖出并积极做空,跟着做空盈利

22:35分大户卖出做空2千万美元的挂单成交,成交后行情下跌

这是AICoin独家指标,首创将大额挂单,显示在K线图上,线宽越宽金额越大,线越长代表挂单时间越长。

2、8小时+MA40大法——跌破MA40均线,行情下跌

8小时周期+ MA40大法,跌破MA40均线,行情大概率下跌;涨破MA40均线,行情大概率上涨。

3、量价分布图——跌破29419支撑,行情持续下跌

量价分布图将成交量绘制在价格轴上,显示成交量在价格点位的分布,蓝色线为最大成交量所在价格位,被视为重要的支撑压力位。

最近都是晚上行情,为不错过今晚行情,立即拥有3大指标:https://www.aicoin.com/vip/chartpro

更有专属群交流,跟群友一起捕抓机会:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。