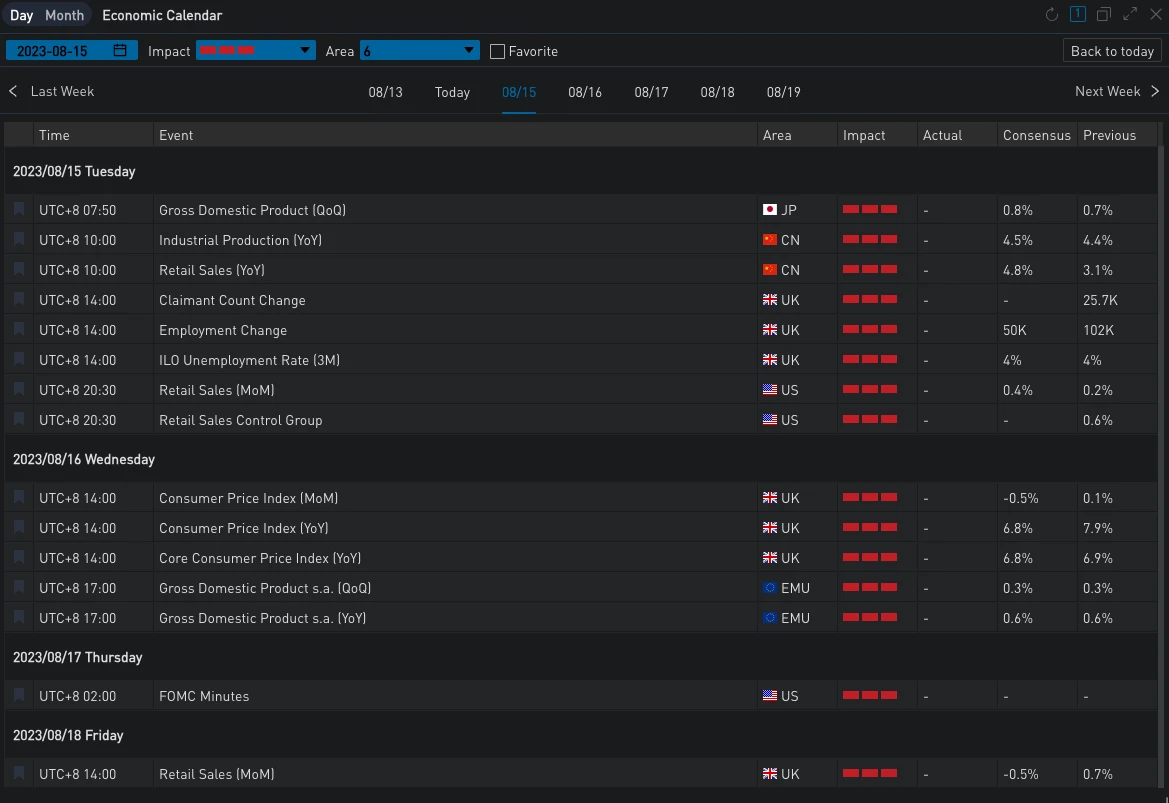

Data released by the US Department of Labor on Friday showed that the US July PPI increased by 0.8% year-on-year, exceeding the expected 0.7% and the previous value of 0.1%, ending 12 consecutive months of decline; at the same time, both overall and core PPI increased by 0.3% month-on-month, the largest increase since January 2023. The higher-than-expected data this time mainly came from the strong growth in the service category, reflecting the increased costs of categories such as healthcare and passenger transportation. Despite the cooling signs shown in the consumer inflation data released on Thursday, this strong PPI data reveals that the stickiness of US inflation seems to be even greater than many people expected. After the data was released, the US bond yield curve rose by 5-7 basis points on the same day, and the futures of the three major US stock indexes fluctuated, with the Dow rising by 0.3%, the S&P 500 falling by 0.1%, and the Nasdaq falling by 0.68%.

Source: SignalPlus

Source: Deribit (As of 14Aug 16:00 UTC+8)

Source: SignalPlus

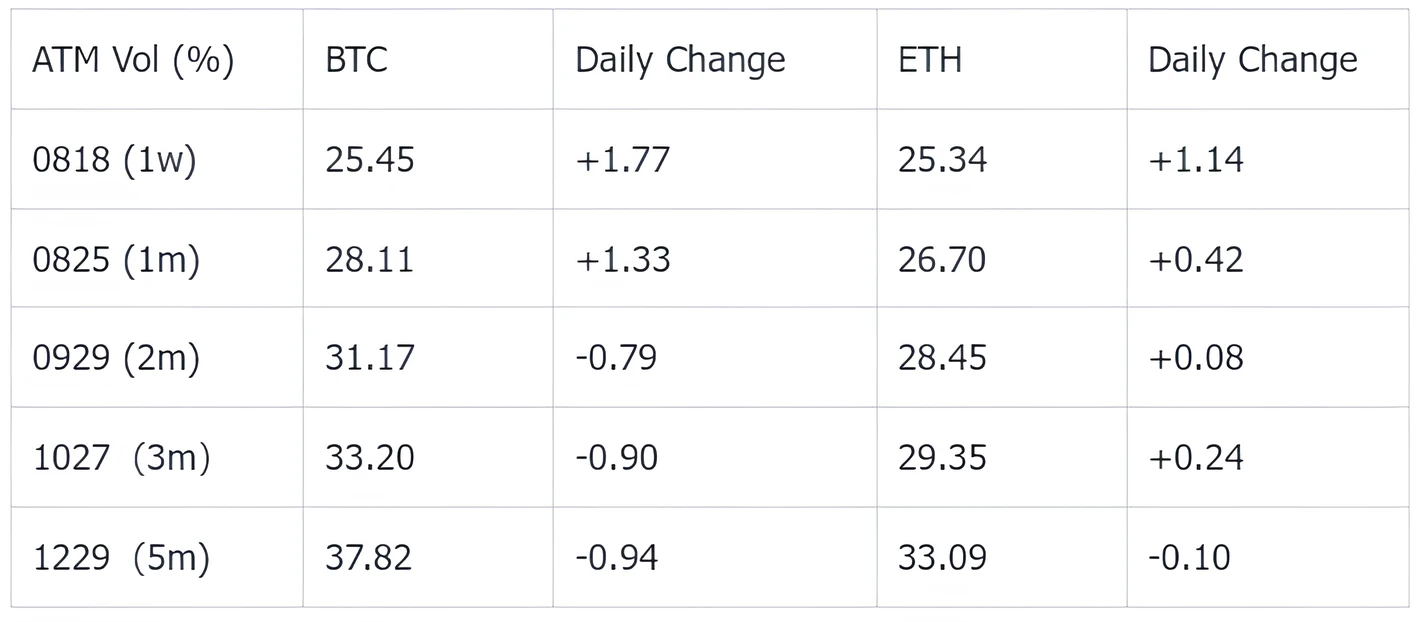

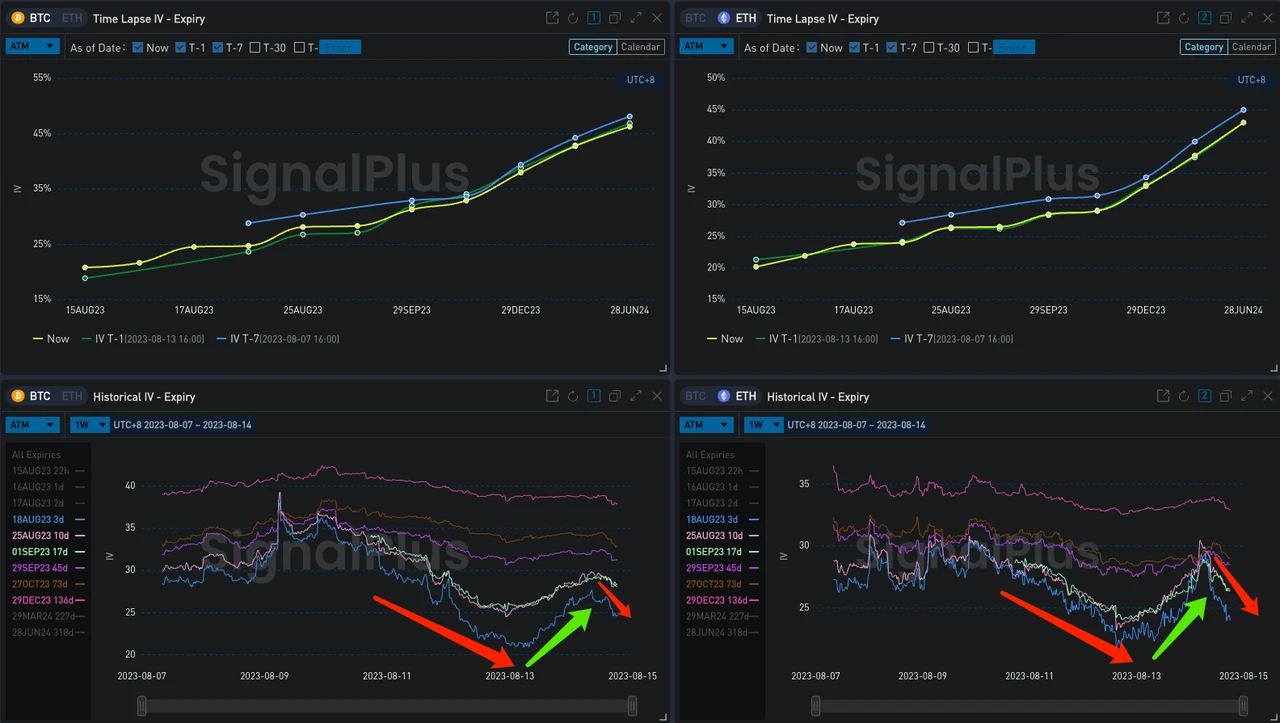

In terms of cryptocurrencies, implied volatility hit a low point last weekend, with the 1-week ATM almost breaking the 20% support level, and then experiencing a sharp rebound as the trading day approached, reaching its peak this morning before the opening of the Asian market (14Aug 07:00 am UTC+8), with the weekly IV amplitudes of BTC/ETH reaching 6.5%/6.8% at one point, and the monthly amplitudes reaching 4.92%/7.27%. However, in the absence of actual coin value fluctuations, the rise brought about by the low liquidity over the weekend was difficult to sustain, and by the time of the author's deadline, the market had retraced nearly half of the gains.

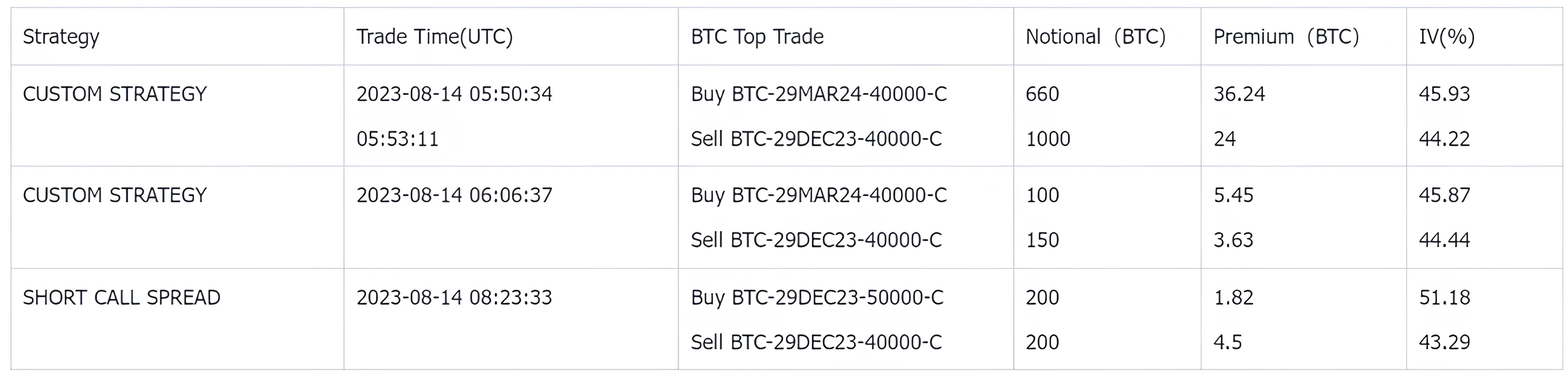

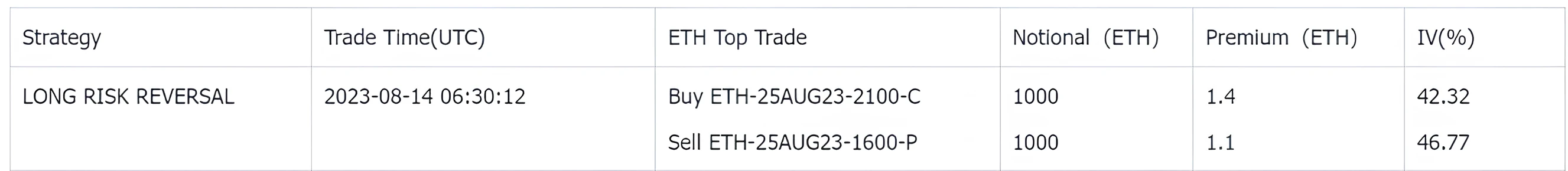

In terms of trading, it was observed that the OI of BTC 29DEC23-40000-C decreased significantly in the past 24 hours (approximately -1000 BTC), mainly due to two large-scale strategic trades. First, the (non-proportional) calendar price spread strategy of 29DEC23-40000-C vs 29MAR23-40000-C. Second, the sale of 29DEC23-40000 vs 50000 Call Spread (200 sets). In addition, there was a large amount of selling of 30000-C in the short term, mainly contributed by Deribit retail investors (approximately 350 BTC), which suppressed the volatility at the front end before the weekend.

The most significant ETH trades were the purchases of 1900-C by Deribit retail investors for the expiration dates of 25AUG23, 1SEP23, and 27OCT23, with a cumulative trading volume of nearly 10,000 ETH.

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web 3, or join our WeChat group (add the assistant WeChat: chillywzq), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。