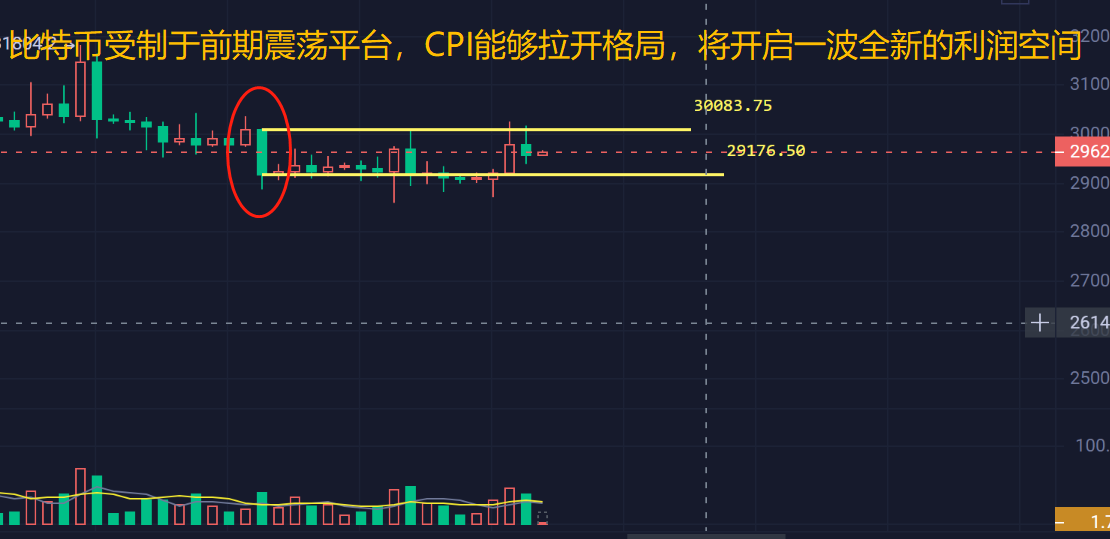

Can CPI change the current market's anxious state? From the current candlestick pattern and cycle arrangement, objectively speaking, the market's trend has reached a turning point between long and short positions. Can it change the market situation and pull it in a new direction? This will require leveraging data to change the situation.

After the release of non-farm payroll data last week, the market's trend experienced a short-lived rebound, followed by a return to the oscillation range. Solely based on the non-farm data, the upward momentum in the market is bound to affect the CPI market momentum. However, the current market supply and demand are subtly changing. It is a mistake to judge the market prematurely based solely on short-term pressure and conclude that there is no momentum or room for upward movement, thus missing the objective analysis of the main players' intentions.

From the current market trend in terms of price rebound strength, steady increase in trading volume, and the reversal of top and bottom formations during pullbacks, in my years of analysis, the market has already begun to enter a rising trend.

In the short term, the pressure for Bitcoin is at 30,000-30,300, and the medium-term pressure is at 32,000. At the daily level, there are no signs of a bearish trend in the market. It is suggested to focus on long positions, with support at 29,500-29,200 and defense at 28,800, targeting 30,000-30,300.

For Ethereum, the pressure is at 1,880-1,890, with medium-term pressure at 1,940. Intraday operations should focus on support at 1,845-1,830, with defense at 1,808 and a target of 1,880-1,890.

The evening CPI data is expected to follow the trend, and the mid-term target will be observed.

To understand the market's internal mechanism, adopt the thinking of the main players, and integrate market behavior, scan the QR code in the public account:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。