Crypto media site The Block was secretly funded over the last two years by Sam Bankman-Fried’s Alameda Research, according to a report by Axios. The Block confirmed the report on Friday.

This article originally appeared in Crypto Markets Today, CoinDesk’s daily newsletter diving into what happened in today's crypto markets. Subscribe to get it in your inbox every day.

Bitcoin (BTC) and Ether (ETH): BTC, the largest cryptocurrency by market capitalization, was trading around $17,140, roughly flat over the past 24 hours. BTC has been hovering at the $17,000 mark for 10 consecutive days. Ether followed a similar pattern, sliding 0.8% to $1,260 as of publication time.

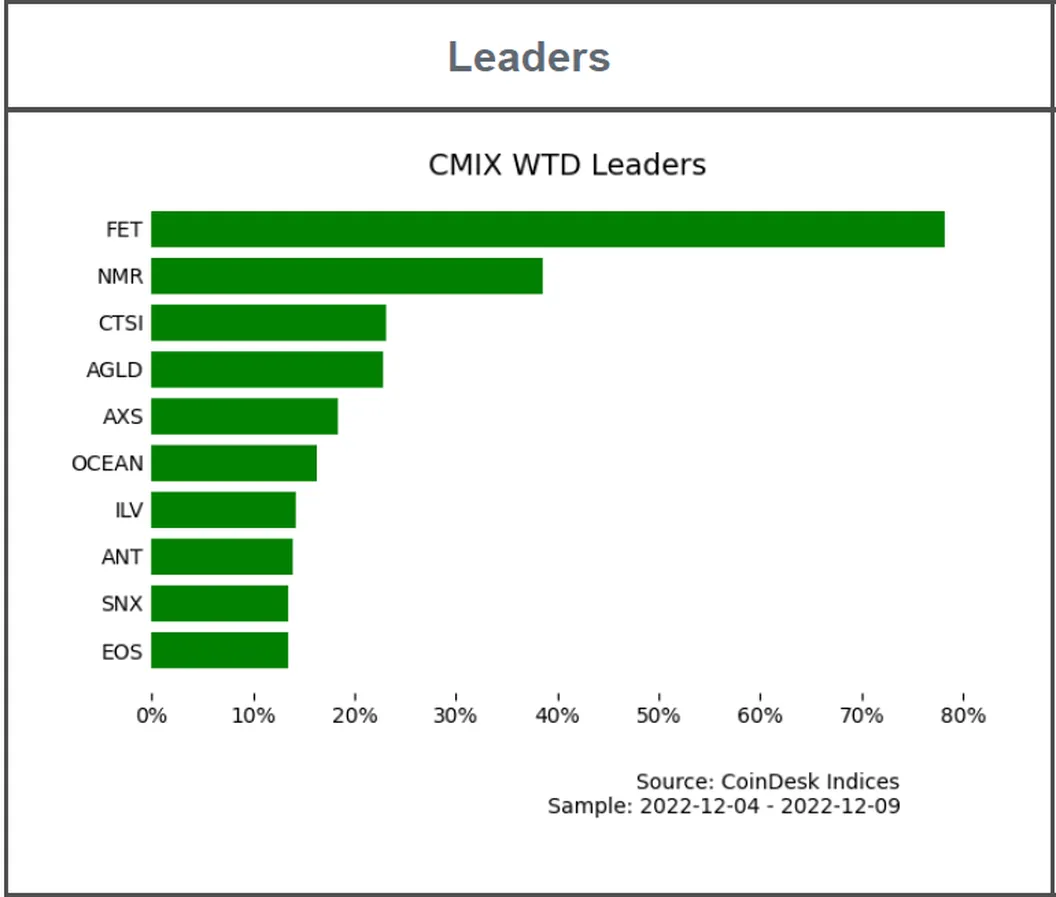

Fetch.ai (FET): The blockchain-based project focused on artificial intelligence (AI) was the top performer this week among the 167 digital assets in the CoinDesk Market Index (CMI). Its native token FET’s price jumped from 6 cents at the start of the week to now 11 cents, surging 80% in the five days since Sunday and 36% in the past 24 hours alone at the time of publication. The price jump came after the release of an upgrade to the Fetch.ai wallet with features, including “more easy-to-use messaging,” “fewer server interactions” and “faster load times.”

FTX Token (FTT): The native cryptocurrency of the failed FTX crypto exchange surged Friday after the platform's founder, Sam Bankman-Fried, came out in support of an exchange revival plan proposed by a crypto influencer Ran Neuner. The FTT token surged as much as 47% to $1.97, its highest level since Nov. 16, after Bankman-Fried's tweet at 08:18 UTC, TradingView data show. The token has since settled back to $1.64.

By Glenn Williams Jr.

Both bitcoin (BTC) and ether (ETH) were essentially flat over the last week, with the two largest cryptocurrencies by market value trading .005% and .006% higher than the last recorded price on Dec. 2. Volume for both has been stable, with trading activity falling slightly below their respective 20-day moving averages.

BTC appears to be bumping up against potential resistance at current levels. A look at the asset’s Volume Profile Visible Range (VPVR) indicator indicates high levels of price agreement at current levels, which can lead to static price movement. If BTC breaks above this level, the next high volume node appears at the $20,000 level.

ETH’s price, since hitting a short-term bottom on Nov. 22, is showing the early makings of a potential uptrend, with prices up 12% since that day. A distinction between ETH and BTC’s recent price action is that ETH has pushed past a high volume node at $1,200 with the next stop above being at $1,340.

Read the full technical take here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。