(Pictures from the Internet)

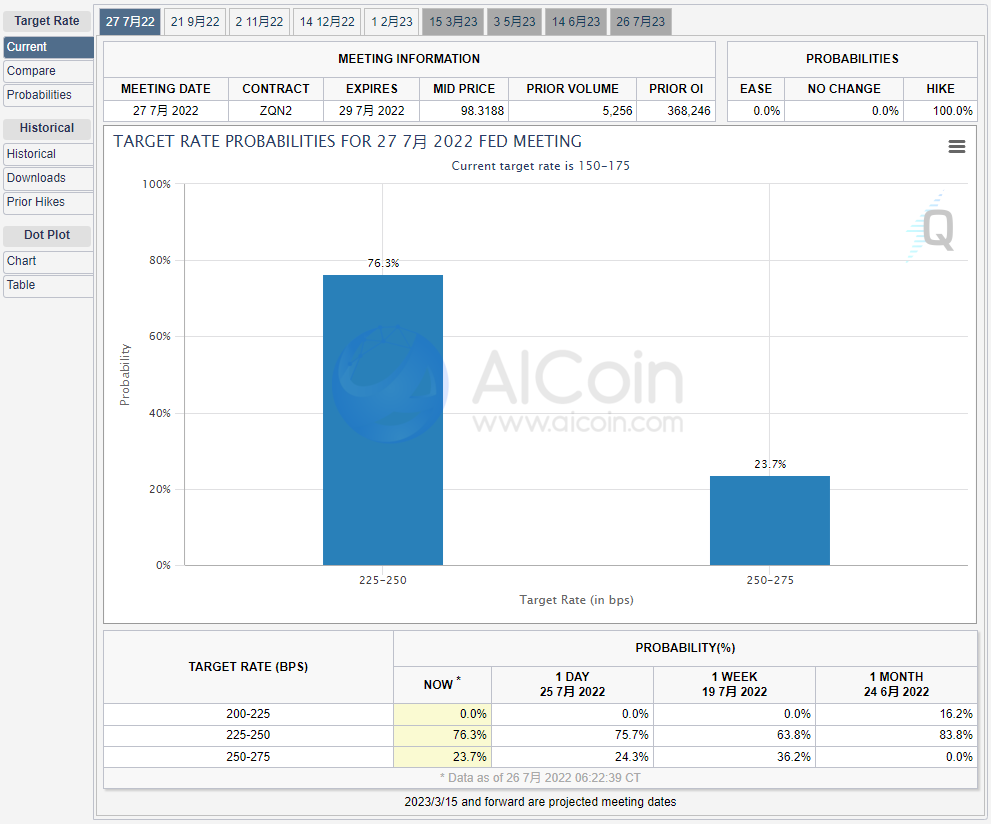

The US. Federal Reserve officially launched the rate hike cycle in March this year. In the first half of the year, it has raised rates three times, in March, May and June. The intensity of interest rate hikes is also larger and larger, with interest rate hike basis points of 25 basis points, 50 basis points and 75 basis points respectively. The first interest rate hike in the second half of the year is expected to be announced at 2:00 a.m. on July 28 (UTC+8). The market predicts that the Fed will likely raise interest rates by 75 basis points in July, that is, to raise the interest rate range to 2.00%-2.25%.

As we all know, the Fed's interest rate meeting is an important economic indicator in the United States. The interest rate decision represents a change in the US monetary policy. Therefore, the Fed's interest rate meeting has become the focus of global attention.

In addition, the Fed rate meeting has always been a major event in the financial market, and each meeting can always cause an uproar in the investment community. In the cryptocurrency market, every move of the Federal Reserve’s interest rate meeting will also have a huge impact on the price of cryptocurrencies. The increase in interest rates means that the liquidity of the financial market will decrease, and a large amount of funds will flow from the encrypted asset market to stable investment, which will weaken the support for the encrypted asset market, and create more uncertainty for cryptocurrencies, which will face more selling risks.

According to AICoin data, since the rate hike by 50 basis points on May 5, the panic and greed index has been below 25, and the market is full of fear.

As far as BTC is concerned, after the rate hike in March, the price of BTC fell back after a brief surge to $48,189.84 on March 29, and the trend continued to be sluggish. Currently, the price of BTC continues to fluctuate in the range of $20,000 to $22,000.

AICoin PRO live charts supports one-key jump to the specified date K-line function, and the cycle can be refined to the second level

In addition, the Fed's interest rate hike is the main factor that causes the volatility of US Treasury bond yields and the US dollar index. The interest rate hike will increase bank interest and Treasury bond yields, and the US dollar will appreciate, and the invested funds will return to banks, government bonds and US dollars. market, resulting in a reduction in market liquidity.

AICoin data shows that since the Federal Reserve announced that it will raise interest rates six times this year, the US dollar index and the yield of the US 10-year Treasury bond have generally shown an upward trend. After the Fed announced a 75 basis point interest rate hike in June, the U.S. dollar index continued to strengthen and rose to 109.3009 on July 14, hitting a new high in nearly 20 years.

AICoin PC supports custom multi-window and cloud multi-layout functions, welcome to open AICoin PRO members

According to historical data, the Fed raising interest rates will have a certain impact on cryptocurrencies, the U.S. dollar index, and U.S. Treasury bonds. For investors in cryptocurrencies, high interest rates can spook short-term investors, while long-term investors may see these shocks and panics as ideal times to buy cryptocurrencies at low prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。