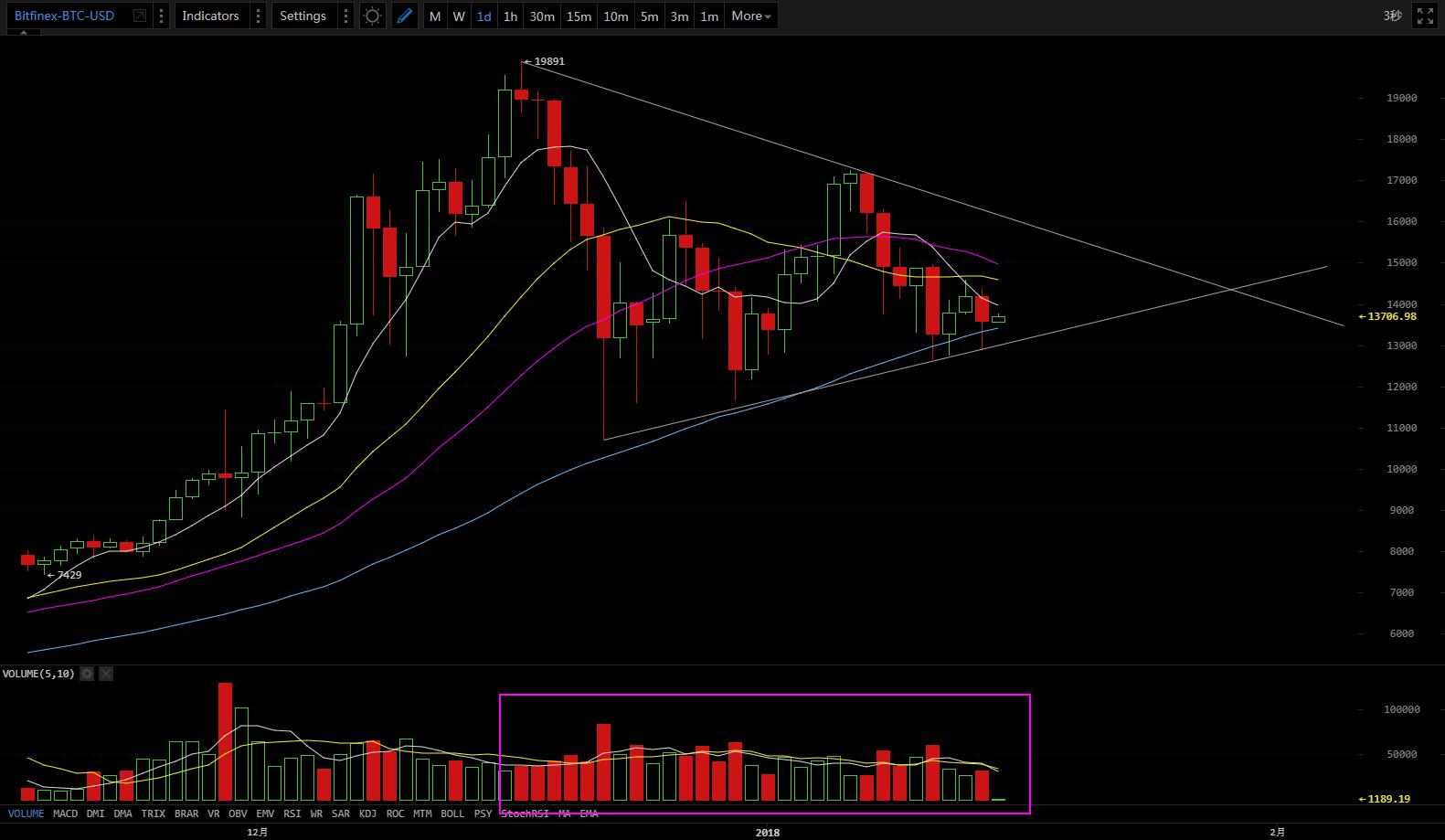

BTC/USD:

Resistance: $14,600, support: $13,000.

Comments:

Overall, BTC remains oscillating within the triangle area as marked after breaking below MA 60 again on daily chart yesterday afternoon. Though strength from bulls seems weak, bears also show their weakness in terms of volumes. Next, it’s very likely for price to oscillate after a bounce as price trend on weekly chart already indicates a tendency to turn around and the fact that MA 60 is becoming flat, at the same time, direction for further moves will be decided after MAs coincide with each other.

Suggestions:

We can see an increasing frequency in the attempts for bears to dump their chips as they face intense resistance around support level of the oscillating range below. As price moves towards the inflection point for bears, a change in trend is very likely to be initiated if BTC breaks below the support level effectively. As a precautionary measure, all your chips can be cashed out now.

BCH/USD:

Resistance: $2,960 & $3,200, support: $2,050 & $1,770.

Comments:

BCH has been consolidating within a broad range since last round of surge. Usually, price will experience a circle of surge – consolidations/corrections – another round of surge. If BCH starts another round of uptrend, however, it will challenge the status of BTC. Besides, it’s reported that BCH has been under the attack from junk trading, if that’s the way for banker to absorb cheap chips, then price holds great possibility to move upwards.

Suggestions:

Positions can be set up around support level as bullish momentum seems strong. Simultaneously, loses must be stopped if BTC starts going downwards.

ETH/USD:

Resistance: $1,340 & $1,380, support: $1,300 & $1,260

Comments:

It’s believed that the main reason for the fact that volumes of ETH have surpassed the total amount of BTC, LTC, BCH, Dash and BTG is caused by the enthusiasm of investing in ICO and altcoins. In the long term, however, ETH holds the greatest possibility to break the control under BTC and move in its own way. On weekly chart, we can see a severe divergence, meaning that a correction will be initiated if BTC goes bad.

Suggestions:

Positions can be set up if BTC price has made its final decision on its direction.

ETC/USD:

Resistance: $42,5, support: $40 & $37.

Comments:

ETC has come to the end of the ascending triangle pattern on hourly chart with expanding volumes and tendency to move upwards, it’s less likely for price to break below the support line at $40 formed by MA 60 before the overall trend turns around.

Suggestions:

Positions can be set up if price breaks upwards with expanding volumes, which will make the short-term trend bullish, adding the bullish sign that price stopped dipping this morning.

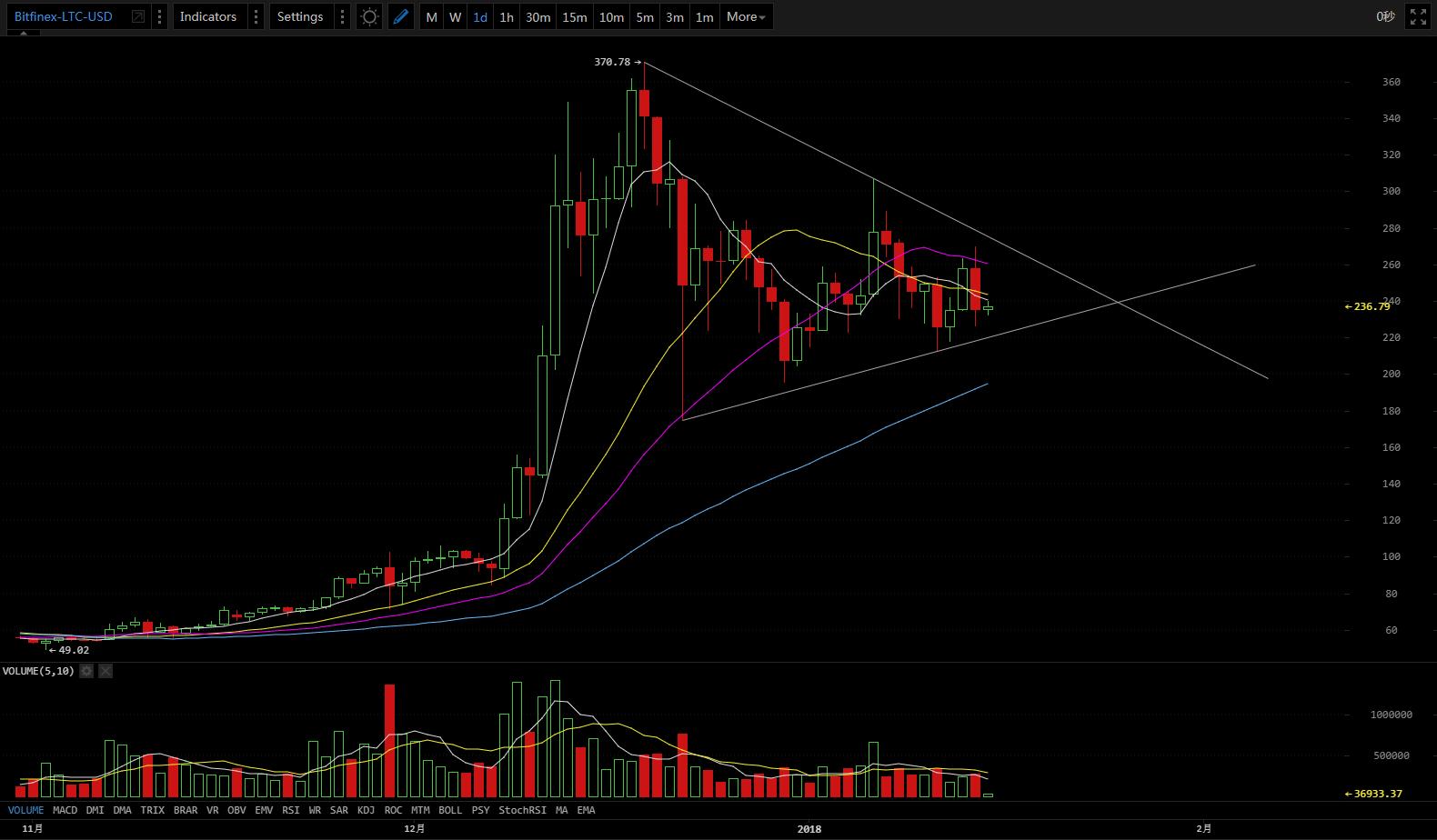

LTC/USD:

Resistance: $261 & $307, support: $220 & $195.

Comments:

The uptrend was stopped when bears started dumping their chips around $270 yesterday, the game between bulls and bears will continue near the major support area at $220 as strength from bears is limited. MA 60 will act as the minor support if price breaks below $195.

Suggestions:

Positions can be set up if price starts bouncing after falling to the support level which can also be set as the stop-loss price.

Original by Hashpai, translated by AICoin Jami.

Disclaimer: The information contained herein is not guaranteed, and is strictly for information purposes only. It does not constitute any trading proposal and will not be liable for any loss based on the information herein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。